HMRC wrongly refunding some voluntary Class 2 NIC payments

Update 31 July 2024: HMRC have now confirmed that they will be writing to all those affected. Around 8,000 people have had their voluntary Class 2 payment refunded incorrectly, and HMRC will be writing to them to explain what steps to take next.

Update 10 July 2024: The following article was originally published on 29 April 2024. Since then, HMRC have confirmed that a processing error has occurred for some voluntary payments of Class 2 in 2022/23 and that individuals will need to check if they have been affected. Full details of how to check and correct the position can be found on the LITRG website.

Earlier this year a number of members reported concerns to us about unexpected refunds of Class 2 voluntary contributions. The issue has been raised with HMRC on the Agent Forum (thread SA-44827) and is awaiting a resolution. In the meantime, as refunds could have implications for future state pension and other contributory benefits entitlement, we are sharing this more widely.

Background

Class 2 NIC is important as it provides entitlement for self-employed individuals towards ‘contributory’ state benefits such as State Pension, Maternity Allowance and Employment & Support Allowance.

The position has recently changed, but for 2022/23, liability to Class 2 depended on the age of the taxpayer (only those under the state pension age at 6 April 2022 were potentially liable) and their self-employment profits.

- Those with profits over £12,570 had to pay Class 2.

- Those with profits between £6,725 and £12,570 were not required to pay Class 2, but the year would still ‘count’ for future State Pension entitlement.

- Those with profits under £6,725 could pay Class 2 voluntarily so that the year would ‘count’ for State Pension purposes.

It is this last group where the problem appears to have arisen.

Collection of Class 2

Class 2 is collected via Self-Assessment (SA) and the payments then need to be transferred to the individual’s National Insurance record. This is done automatically each year by HMRC.

However, for voluntary Class 2 payments to be accepted via SA, they must be paid by 31 January. It appears that this year, the process which moves the payment from the SA computers to the NI records was run late. The result is that some taxpayers who had paid their tax (including voluntary Class 2) by 31 January 2024 have been told that their Class 2 element was paid late and cannot be accepted. They have been issued with a revised income summary and tax calculation (SA302) rejecting the Class 2 payment and refunding the £163.80 paid.

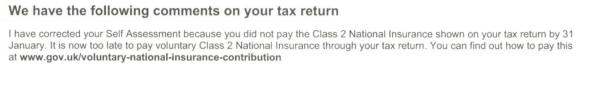

The SA302 will have a message like the following.

Correcting the position

Assuming the individual still wants to pay their Class 2 and obtain a ‘credit’ for 2022/23 towards their State Pension, further action is now needed. It is necessary to ring up the NI Contributions office (0300 200 3500) to obtain a payment reference and then make a special payment direct to them. It is not possible to simply pay the amount back onto the Self-Assessment account.

HMRC say they are currently looking into the issue. In the meantime, members may wish to check that any clients who have tried to pay Class 2 voluntarily have not had payments incorrectly returned.

If you have further comments or feedback on this issue please let us know at [email protected].