Last updated: 19 December 2023. If you are reading this at a later date you are advised to check that that position has not changed in the time since.

As more and more businesses go digital, it is common to see expenses incurred in connection with software licences and developing and maintaining websites. However, determining the correct tax treatment of such ‘digital expenses’ can be challenging.

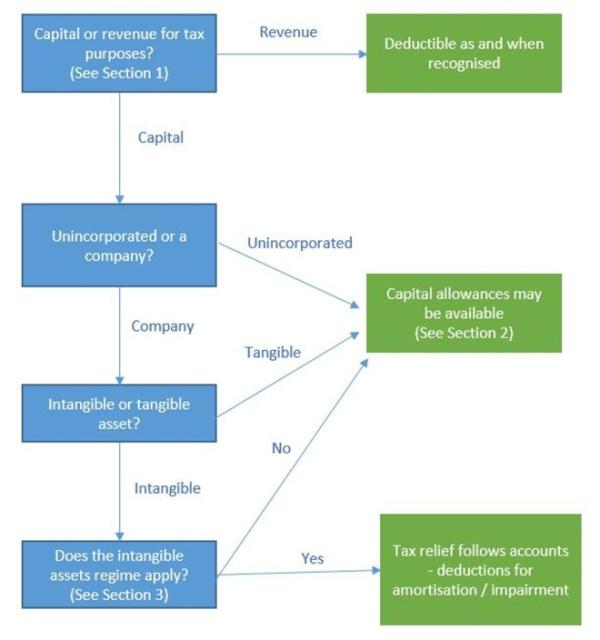

Broadly the tax treatment of such expenses will depend upon:

- whether they are capital or revenue in nature for tax purposes;

- whether they are incurred by an unincorporated business (e.g. sole trader or partnership) or a company1; and

- if incurred by a company, whether or not they fall within the intangible assets regime.

The potential outcomes can be summarised as follows:

This article takes a brief look at the above questions and sets out some practical points to consider when determining the tax treatment of software and website costs. It does not cover accounting treatment and is not meant to be a definitive guide to the tax treatment of digital expenses. In each case, the correct tax treatment will depend upon the specific facts and circumstances associated with the expenses in question.

1. Capital or revenue expenditure?

The first question to consider when looking at tax treatment of digital expenses is whether they are capital or revenue in nature for tax purposes.

This is not simply a matter of checking how they are treated for accounts purposes (i.e. whether the expenses are capitalised on the balance sheet or charged to the profit and loss account). Whilst the accounting treatment may be persuasive, it doesn’t determine the classification of expenditure for tax purposes.

Tax law doesn’t define what is meant by ‘capital’ and ‘revenue’, but several tests have been developed through case law. Two of the key tests for expenditure to be capital in nature are:

- Has an identifiable asset been acquired, disposed of or modified?

- Was the expenditure incurred with a view to providing an ‘enduring benefit’ to the business?

There is no strict time limit which can be applied when considering whether expenditure is capital in nature. However, HMRC will normally accept that expenditure on an asset with a useful economic life of less than two years is revenue in nature as the asset will not bring lasting benefit to the business.

1.1 Software

Where software is acquired under licence, whether the expenditure is revenue or capital in nature will depend on:

- Whether the licence is acquired for a lump sum or regular payments.

- If acquired for a lump sum, what the useful life of the software is.

If a software licence is paid for by regular periodic payments akin to a rental, HMRC will normally accept that those payments are revenue in nature.

If a lump sum payment is made for a licence it will be necessary to consider whether the licence will have a sufficiently enduring nature to be classed as a capital asset. This requires consideration of both the function of the software and how long it will last. As noted above, HMRC will generally accept that a payment is revenue in nature if the useful life of the software is expected to be less than two years. However, they will not accept that software has a limited life solely because new updated versions are released at intervals of less than two years – the question is whether the business actually trades up to the new version at sufficiently short intervals.

If businesses develop their own software, the classification of expenditure relating to this (including salaries of in-house IT staff) should be assessed following the same principles. The fact that expenses such as salaries may be recurring does not, on its own, prevent them from being capital in nature. However, it should be noted that:

- The salaries of IT staff will not normally be capital expenditure unless some major new project can be identified.

- If staff are making only piecemeal changes or minor improvements to software, their salaries are likely to be revenue costs.

HMRC provide extensive guidance on the treatment of in-house software development costs in the Business Income Manual (See BIM35820 onwards).

Where a single payment is made to acquire computer hardware and a software licence together as a package, HMRC take the view that the expenditure should be apportioned between the two elements. However, where apportionment will not have significant tax consequences (for example because both the hardware and software are capital assets for tax purposes) no apportionment will be needed in practice.

1.2 Website costs

Whether website expenditure is capital or revenue in nature will depend upon:

- the nature of the expenditure, and

- the function which the website performs in the business.

Design and content development costs should normally be treated as capital expenditure to the extent that an enduring asset is created.

Where a website directly generates sales, subscriptions, advertising or other income this will normally be considered to be an enduring asset. It is, however, also necessary to confirm that the website will have the lifetime normally expected of a capital asset (as noted above, anything under two years is likely to be accepted as revenue expenditure).

HMRC’s position is that the following should normally be treated as capital expenditure:

- Application and infrastructure costs.

- Domain names.

- Hardware.

- Operating software that relates to the functionality of a website.

However, not all website related costs will be capital in nature. In particular, HMRC will normally accept that the following are revenue costs:

- Initial research and planning costs prior to deciding to proceed with development.

- Costs associated with maintaining or updating a website (for these purposes the website can be thought of as analogous to a shop window – the cost of constructing the window is capital, but the costs of changing the display from time to time is revenue).

All expenses relating to business websites need to be analysed against the above criteria. These could be recorded as marketing, advertising, IT costs or wages and salaries. As noted above, treating a cost as a revenue expense for accounting or book keeping purposes does not necessarily mean that it will be treated as revenue for tax purposes.

2. Tax treatment – unincorporated businesses

The tax treatment of an expense for an unincorporated business will flow directly from its classification as revenue or capital for tax purposes:

- Revenue expenditure will generally be fully deductible for tax purposes at the time it is recognised.

- Capital expenditure cannot be deducted for tax purposes, but capital allowances may be available.

To qualify for capital allowances, the asset resulting from the expenditure will have to function as plant – broadly be a capital asset used for carrying on the business, and not stock in trade or part of the premises.

It should however be noted that computer software specifically qualifies for capital allowances under s71 CAA 2001. For these purposes, HMRC’s Capital Allowances Manual states at CA23410 that “You should treat computer programs of any type and data of any kind as computer software.” .

3. Tax treatment - companies

The corporation tax regime includes specific rules regarding the tax treatment of intangible assets, referred to as the ‘intangible assets regime’, which can be found in Part 8 of CTA 2009. This means that the tax treatment of digital expenses can be more complicated for companies than unincorporated businesses (which do not have an equivalent to the intangible assets regime).

For companies there are broadly three possible scenarios depending on whether expenditure is revenue or capital for tax purposes and, if capital, how it is treated for accounts purposes:

- The expenditure is revenue in nature - generally deductible in full at the time it is recognised in the accounts.

- The expenditure is capital in nature and accounted for as a tangible asset - capital allowances may be available if the asset functions as plant or is software (as set out above for unincorporated businesses).

- The expenditure is capital in nature and accounted for as an intangible asset - the intangible assets regime may apply.

Licences and rights over software, website development costs and domain names will often be accounted for as intangible assets, and will therefore fall within the intangible assets regime provided they were created or acquired from an unrelated party on or after 1 April 2002. Where this is the case, the tax relief will follow the accounting treatment with amortisation or impairment of the asset usually deductible for tax purposes as and when recognised in the accounts.

However, if intangible assets were:

- created or acquired before 1 April 2002, or

- acquired from a connected party (or parties) who created / acquired them before 1 April 2002

then the intangible assets regime will not apply.

It should also be noted that software is excluded from the intangible assets regime2 if:

- it is treated for accounting purposes as part of the related hardware; or

- the company makes an election under s815 CTA 2009 to exclude it from the regime.

An asset will also be completely excluded from the intangible asset regime if it is treated as an intangible asset in the company’s accounts but in a previous accounting period was treated as a tangible asset on which capital allowances were claimed (for example on a change of accounting standards).

Where any of the above applies to exclude an asset from the intangible assets regime, it may qualify for capital allowances instead.

It may be beneficial to make an election under s815 CTA 2009 if claiming capital allowances would give relief faster than deducting the amortisation or impairment costs recognised in the accounts (for example, because the Annual Investment Allowance (AIA) or full expensing will cover the expenditure in full or the intangible asset will be amortised over a long period).

4. More information

The following HMRC guidance may be useful in determining the correct tax treatment of digital expenditure:

- HMRC’s Capital v Revenue Expenditure Toolkit provides guidance on some of the common errors HMRC find in relation to capital vs revenue expenditure.

- HMRC’s Business Income Manual at BIM35000 onwards provides more information on the capital/revenue divide generally.

- HMRC’s Capital Allowances Manual contains more information on capital allowances for computer software at CA23400 onwards.

- HMRC’s Capital Allowances manual contains further guidance at CA21000 as to the meaning of plant for capital allowances purposes.

- Further guidance on the intangibles assets regime can be found in HMRC’s Corporate Intangibles Research and Development Manual at CIRD10000 onwards.

1. Note that an LLP is a body corporate, but treated as transparent for tax purposes. For an LLP, the relevant question will be whether the member is an unincorporated entity or company.

2. The level of ‘exclusion’ from the intangible assets regime depends upon the reason:

- Where software is treated as part of hardware, the asset is excluded from the regime except as respects royalties paid or received in respect of that software.

- Where a s815 election is made, the asset is excluded except for royalties, receipts recognised as the accrue (except to the extent brought into account for capital allowances purposes), debits on reversals of accounting gains previously brought into account and realisations (except that credits are only brought into account if they are not brought into account as disposal values for capital allowances purposes, and no deductions are made from receipts on the realisation of the asset under s635 and s736 CTA 2009).