Association of Taxation Technicians - find out more about who we are and what we do.

Did you know people used to block up their windows to avoid paying tax? Primary school children will love this dark tax tale from the past!

Did you know there used to be a tax on having a beard? Primary school children will love this hairy tax tale from the past!

Imagine paying tax just to keep clean! Primary school children will love this smelly tax tale from the past!

Learn all about what taxes are and why they are so important, find out about some of the different taxes and how taxes are paid.

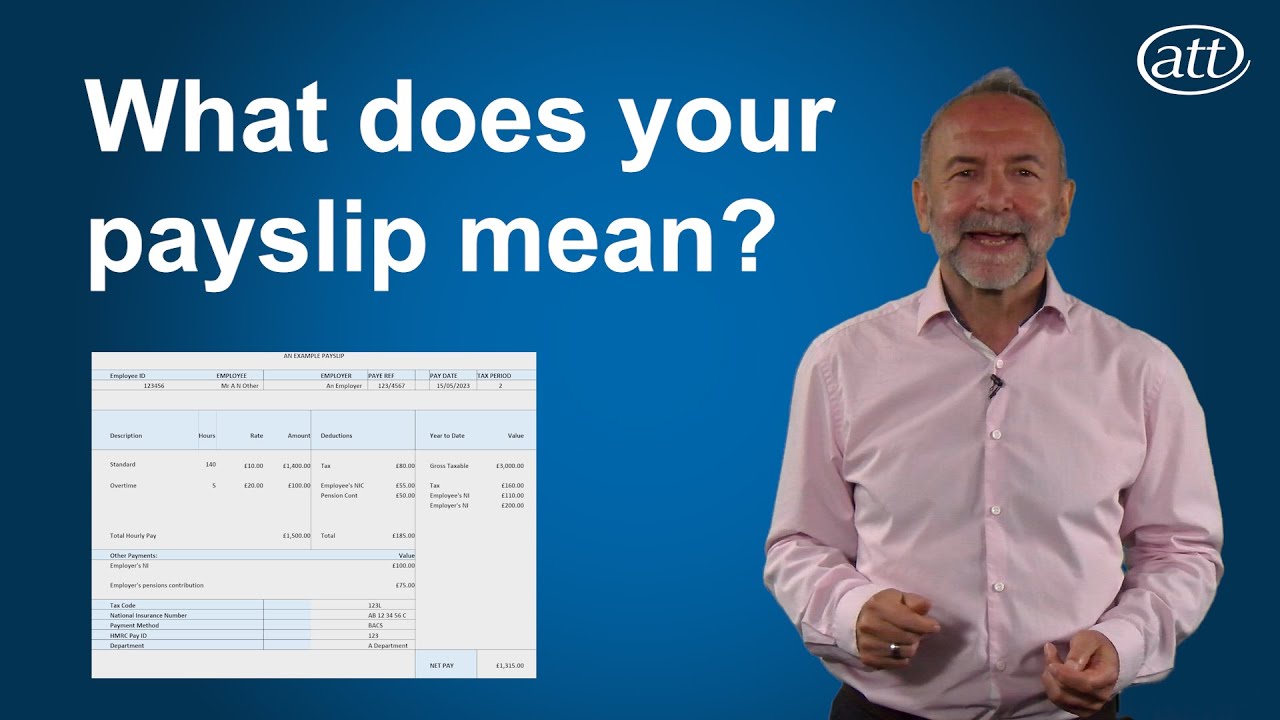

Find out what all the numbers on your payslip mean, and why you should always check them carefully.

We explore the different types of working, and what they mean in terms of tax.

VAT is the one tax that pretty much everyone pays at some point in their life, but it can also have some weird and wonderful rules.

Everything you need to know when considering whether a career in tax is right for you.

Our Foundation Qualifications offer a route into a career in tax and can act as a launch pad for further studies.

Find out what the qualification covers, how it works and why learning about Transfer Pricing is so important.

As a tax professional, you can help your local community by delivering lessons on tax to primary and secondary school children.

It really pays to be an ATT member, take a look at how to become a member, and the various benefits that membership can bring you.

Find out more about at all the different ways members can get more involved with the ATT.

Find out about the important work of the ATT’s Technical Steering Group (TSG) in developing a better tax system and how ATT members can get involved.

Find out all about the top five expenses you might be able to claim tax relief for as an employee and how to claim.

Are you entitled to tax relief on working from home expenses?

Understanding what's on your PAYE end of year tax certificate - form P60.

Do you know what your tax code means, and what to do if you think it's wrong?

Do you have a side hustle? In this video we bust the five biggest tax myths and set the record straight

Have you started a new business? Don't let tax trip you up - find out what you need to do and when.

Do you make a bit of extra income? Find out about how the trading allowance can save you time, money and paperwork.

Are you self-employed? Understand if Making Tax Digital will affect you, what it involves, and when you might need to comply with it.

Are you a landlord? Understand if Making Tax Digital will affect you, what it involves, and when you might need to comply with it.

Are you worried about choosing a tax advisor? Here are some tips on what to look for.

Find out what to do if you're not sure whether a communication from HMRC is genuine, or a scam.

If you are self-employed and work from home, find out what expenses you might be able to claim.

Find out what help you can get towards your childcare costs with the Tax Free Childcare scheme.

Higher rate tax payers may be missing out on valuable tax reliefs, some points to think about if your income is over £100,000.

Many people worry about having to pay more tax as their income increases. In this video, we’ll explain what becoming a higher-rate taxpayer really means.

Understand the basics of the High Income Child Benefit Charge for families claiming Child Benefit, and why it can be complicated.

A look at what you need to know about tax if you have savings.

Have you received a Simple Assessment? In this video, we’ll talk though what a Simple Assessment is, why you need to check it carefully and when you need to pay.

We look at different scenarios to help you understand how tax applies to the state pension and how you pay it.

If you are married or in a civil partnership, and one of you earns less than the personal allowance, you might be able to save tax thanks to the marriage allowance.

Useful links

Links referred to in the Claiming Tax Relief for Common Employment Expenses video:

Links referred to in the Tax Relief for Homeworkers video:

Careers in tax

Hear from ATT members about their career in tax, and where the ATT qualification has taken them

The key elements of studying ATT

ATT member Jake Cross talks about studying ATT

ATT member Georgiana Head talks about studying ATT